Maple Shade Township | 200 Stiles Avenue, Maple Shade, NJ 08052 | Phone: 856-779-9610 | Fax : 856-779-2524 | Contact Us

Tax Collector

Tax Collector

Directory

Tax Collectors Office

(856) 779-9610

(856) 779-1059 Fax

Tax Collector

Christine Taylor

(856) 779-9610 x156

Deputy Tax Collector

Jayne Eastwick

(856) 779-9610 x156

Tax / Utility Collections Collector

Claudine Lanutti

(856) 779-9610 x156

Part-Time Cashier / Account Clerk

Deanna Carlin

(856) 779-9610 x150

Water and sewer non-billing questions contact

(856) 488-7450 (Woodard and Curran)

Quick Links

2024 Dog License Information

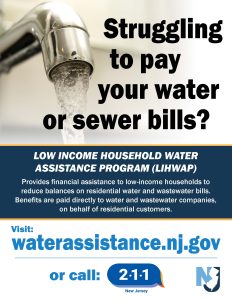

Low Income Household Water Assistance Program

Property Tax Relief & Payment Option Information

Property Tax Relief Programs

State of New Jersey Property Tax Relief Programs –

Municipal Property Tax Relief Programs

Veteran Deduction: Contact Tax Assessor’s Office at 856-779-9610 or www.mapleshade.com/tax-collector/ for Qualifications and Application.

Property Tax Deduction for Senior Citizens or Disabled Persons: Contact Tax Assessor’s Office at 856-779-9610 or www.mapleshade.com for Qualifications and Application.

Payment Options

Online Payments : To review and pay your Taxes & Utility Bills online go to ”View & Pay your Taxes & Utilities”.

Bill Pay: This option is through your bank. When using this option, please identify the property that the payment is intended for.

Example: Taxes use the Block & Lot and Utilities use the Account Number.

Unidentified checks will be mailed back to the address on the check.

Please Note: Bill Pay checks take at least 7-10 days to reach the Tax Collector’s Office.

Checks & Money Orders: With this option your payment may be mailed or placed in the “Drop Box” which is located to the left of the main entrance to the Municipal Building.

Overview

The Tax Collector is responsible for the billing, collection, reporting, and enforcement of municipal taxes and other municipal charges for the Township of Maple Shade. Tax bills are mailed out annually.

PROPERTY TAXES ARE DUE:

FEBRUARY 1ST

MAY 1ST

AUGUST 1ST

NOVEMBER 1ST

Failure to receive a tax bill DOES NOT exempt you from paying taxes or the interest due on delinquent taxes. The Township of Maple Shade does permit a 10 day grace period. Please be advised that the State of New Jersey DOES NOT allow the Tax Collector to acknowledge postmarks, therefore, the taxes must be received in our office on or before the 10th. Should the 10th fall on a weekend or a legal holiday, you will have until the next business day to make payment. Payments may be made by cash, check or money order.

Assessments

The Tax Collector is responsible for the billing and collection of taxes. The Tax Assessor is responsible for establishing the taxable value of your property. Any questions regarding the assessed value of your property should be directed to the Tax Assessor’s Office at 856-779-9610 ext 164.

Due Dates And Interest

Interest charged on unpaid taxes remaining unpaid by the end of the grace period are subject to interest at a rate of 8% per year for delinquencies up to $1,500 and 18% for delinquencies over $1,500. Please be advised that once a delinquency reaches the 18% threshold, the account must be paid current before the interest rate reverts back to 8%. Note that if taxes are not paid by the end of the grace period, interest is charged back to the actual due date of the 1st. It is also important to note that the date of receipt by the Tax Collector, not the mailing postmark is used to determine the delinquency date. Any account with a current year delinquency together with the accrued interest totaling in excess of $10,000 is subject to an additional 6% year end penalty if current taxes are not paid by December 31st of any given year.

Tax Sale

The Tax Collector is required by state statute to hold an annual tax sale each year for the prior year’s unpaid municipal charges. Municipal charges include, but are not limited to, taxes, water, sewer, and maintenance liens. Your property IS NOT SOLD at the tax sale; a lien is placed on your property. The lien holder pays the debt owed to the municipality by the assessed owner of the property. The tax sale certificate that is issued is the detailed receipt of what the lien holder purchased at the tax sale. If a lien is sold to an outside entity and is not paid within two years of the date of the tax sale, that entity may start foreclosure proceedings. Lien holders record the liens at the Burlington County Clerk’s Office to ensure redemption of the lien if the property is sold. Once a lien is placed on a property, the lien holder has the right by state statute to pay any municipal charges that are billed to the property once they become delinquent, consequently, that amount paid by the lien holder is then added to the lien.

Most liens are sold to outside entities but on occasion, the municipality retains the lien. If a lien is held by Maple Shade Township, they may begin foreclosure proceedings six months from the date of the tax sale.

Liens MUST be redeemed in full with CERTIFIED funds through the Tax Collector’s Office. Assessed owners of a property are ultimately responsible for the municipal charges even if you are escrowing through a mortgage company. However, the mortgage company has every right to pay any tax or other municipal charges at any time as they have an interest in the property.

Clear title cannot be issued for a property with a recorded lien attached to it.

Property Tax Deductions

Senior Citizen Annual Property Tax Deduction:

Annual deduction of $250.00 from property taxes for homeowners age 65 or older who have been in their home since October 1st of the pre-tax year, and whose income is less than $10,000/year, after a permitted exclusion of one of the following:

- Social Security Benefits

- Federal Government Retirement/Disability Pension State, County

- Municipal Government Pension

Every Senior Citizen who qualifies for the deduction will receive a PD5 form from the Tax Collector’s Office annually (in February) which needs to be filled out and returned to the Tax Office on or before MARCH 1ST to retain your deduction once it has been approved.

Disabled Person Annual Property Tax Deduction:

Annual deduction of $250.00 from property taxes for homeowners age 55 or older who have been in their home since October 1st of the pre-tax year, and whose income is less than $10,000/year, after a permitted exclusion of one of the following provided they meet the qualifications of totally disabled person:

- Social Security Benefits

- Federal Government Retirement/Disability Pension State, County

- Municipal Government Pension

Every Disabled Person who qualifies for the deduction will receive a PD5 form from the Tax Collector’s Office annually (in February) which needs to be filled out and returned to the Tax Office on or before MARCH 1ST to retain your deduction once it has been approved.

Veterans/Widow of a Veteran

Annual deduction of $250.00 from property taxes for qualified war veterans and their unmarried surviving spouses who have been in their home as of October 1st of the pre-tax year.

In order to received any of the above deductions you MUST APPLY.

Must submit an Income Statement form

when applying for a Senior Citizen

Deduction or a Disabled Person Deduction.

Forms are available in the Tax Assessor's Office or online at the following locations

In order to receive the deduction or exemption you MUST APPLY. Please read and fill in the application of the deduction completely.

Please read and fill in the application of the deduction completely and return to the Tax Assessor’s Office.

*Must submit an Income Statement form with the senior of disabled deduction form.

Property Tax Relief Programs

Or call the Homestead Benefit Hotline at 1-888-238-1233 (within NJ, NY, PA, DE, and MD)

- Get program information

- Office hours are Monday, Tuesday, Thursday, and Friday 8:30 a.m. to 5:30 p.m. and Wednesday from 10 a.m. until 5:30 p.m., except State holidays

Senior Freeze (Property Tax Reimbursement) Information Line – 1-800-882-6597 (within NJ, NY, PA, DE, and MD)

- Inquire about the status of your reimbursement check

- Office hours are Monday, Tuesday, Thursday, and Friday 8:30 a.m. to 5:30 p.m. and Wednesday from 10 a.m. until 5:30 p.m., except State holidays

Name and Address Changes

The Tax Assessor’s Office is responsible for records of ownership. All name and address changes for tax records MUST be made through their office. The Burlington County Clerk’s Office forwards new deed information to the Tax Assessor’s Office on a regular basis. The Tax Collector’s Office updates property information through the Tax Assessor’s Office.